Learn Deep Side of SAP S/4HANA Finance

Category: SAP S/4HANA Finance Posted:Jul 03, 2020 By: Serena Josh

SAP S/4HANA Simple Finance (sFin) is the financial and accounting component of SAP Business Suite for HANA (S/4HANA). SAP increasingly refers to S/4HANA Finance as the SAP S/4HANA Finance solution in anticipation of tighter packaging with the SAP Analytics Cloud.

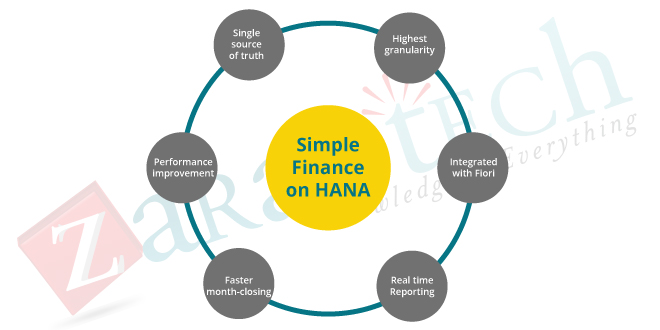

SAP S/4HANA Simple Finance is an ERP Financial Software that runs on SAP HANA’s in-memory platform which allows users to run real-time reports on operational and financial data. Like other products on the HANA platform, the data is saved and processed in memory so you can analyze data quickly with few constraints. For instance, you can run a soft close any time of the day, month, or quarter with up-to-minute accuracy.

As part of the ERP package, financial data, as well as operational data, are drawn from one centralized location, which enables decision-makers to analyze problems from an organizational view rather than a limited department view. Simple Finance can be hosted in the cloud or on-premise, but SAP seems to be emphasizing S/4HANA Cloud. Nevertheless, there are no indications that SAP plans to discontinue support customers that choose to host S/4HANA on-premises.

Simplification of SAP S/4HANA Finance

The “Simple” in Simple Finance refers to what SAP refers to as a “single source of truth.” All data, both financial and operational, comes from one source which eliminates the need for data replications, reconciling data, and removing redundancies. Simple Finance calculates financial data in the HANA in-memory platform which allows you to run trial Balance Sheets, Profit, and Loss Statements, and Cash Flow Analysis reports using real-time data. There’s no need to wait for the completion of the day, month, or quarter so you can instantly access your data for planning and decision-making.

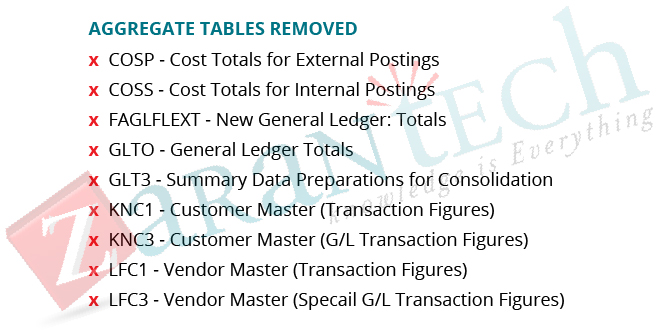

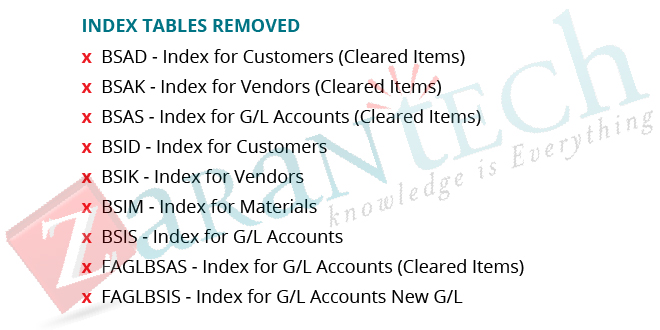

The simplification between ECC and HANA with an in-memory database is that SAP has removed all the index and aggregate tables. SAP replaced these tables with ACDOCA-Single Source of Truth in the 1503 launch (2014). This combined the FICO data from the distributed ERP with SAP or a third-party database. The next significant release, S/4HANA, eliminated third-party databases to make sure that all data is stored and processed on the in-memory SAP HANA platform. The result is a single live data source with a high level of granularity.

The architecture of SAP S/4HANA Simple Finance

SAP S/4HANA Simple Finance utilizes a Universal Journal as a single repository to record journal entries across several applications.

A single repository removes redundancies and provides clean data for management accounting, asset accounting, and materials ledgers. The Simple Finance platform only stores data once, so there is no need for reconciliation. Every transaction is promptly available to every decision-maker in your organization to answer questions and run reports.

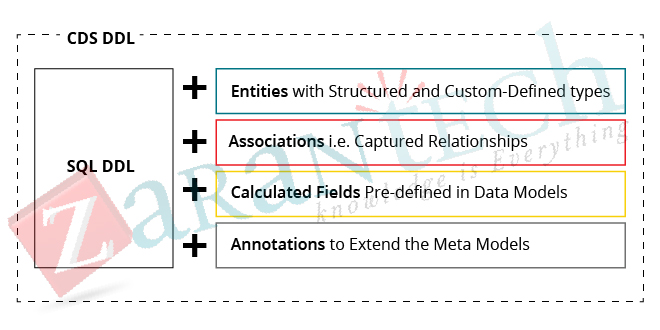

SAP’s single source of truth concept includes Financial Accounting (FI) and Control and Management Accounting into the ACDOCA table. Most of the index tables, aggregate tables, and the materials ledger have been removed and replaced with HANA Core Data Services (CDS) views.

Want to Boost Your Skills? Click here

Code Data Service(CDS) is the data modeling infrastructure for SAP HANA. CDS boost SQL’s Data Definition Language (DDL) to enable users to create expressions for calculations and queries, associations, as well as domain-specific metadata.

Key Functionalities of SAP S/4HANA Simple Finance

- Financial Accounting (FI)

The financial accounting options include all the features you would expect in an ERP finance tool: G/L, Accounts Receivable, Accounts Payable, Contract Accounts, Bank Management, Travel Management, Asset Management, and Consolidation Tools. There is also a special purpose ledger for user-defined database tables. You can use this ledger for non-standard data, parallel accounting, fiscal year variants, and so on. The data in the special purpose ledger receives data only; it does not send data to other SAP applications.

The key difference between SAP S/4HANA Simple Finance, as well as traditional ERP finance applications, is the additional ability to quickly access and analyze live data. By removing the need for batch-processing and reconciling numerous tables at the period end, SAP S/4HANA Simple Finance permits you to run accurate soft-close whenever you require the information. Real-time Key Performance Indicators (KPIs) refresh quickly and automatically.

- Management Accounting (CO)

Management or Control Accounting Modules consist of cost element accounting, cost center accounting, profit center accounting, internal orders, product costing, and profitability analysis.

Posting Logic in New Asset Accounting

SAP S/4HANA Simple Finance sustains both account-based profitability analysis and cost-based profit analysis. The S/4HANA account-based strategy utilizes the Universal Journal to determine the real-time cost of goods sold (CoGS) which allows you to drill down to study profit and loss centers based on different contribution margins. Real-time derivation of profitability characteristics opens the possibility of analyzing the impact of single events on profitability.

Cash Management

The SAP S/4HANA Simple Finance Cash Management tool is completely integrated and enables a user to run bank management procedures without switching between modules. Bank Account Management has a single point of entry to access bank settings and set user privileges. Fraud prevention workflow controls require multiple manager authorizations to transform the master settings.

Daily cash operations are simplified and automated. Forecasting tools for accounts receivable and accounts payable transactional data can be utilized to automatically approve payments. You can drill-down to the details of any payment. Reports consist of short-term cash forecasting and real-time cash positions. You can also see your organization’s cash position on bank statement processing and initiate bank account transfers from the cash position reporting interface.

Liquidity Planning

Liquidity Planning is integrated with sFin’s cash management solution. The details are drawn from internal sales and purchase orders to identify potential liquidity deficits as well as surpluses. Some reviewers question the accuracy of this tool because it does not incorporate external sales data in the forecasting model. SAP plans to improve data quality and integrity with future releases.

Go through our SAP S/4HANA SIMPLE FINANCE EXAM C_TS4FI_1610 Certification Made Easy to crack the Interviews.

Conclusion

SAP plans to transform SAP S/4HANA Finance into an intelligent ERP that can leverage Machine Learning and apply Predictive Analytics to the data explosion expected from the Internet of Things (IoT). Future releases include a personalized digital assistant driven by Natural Language Processing (NLP) and Artificial Intelligence (AI) to guide users with the process of using the data to boost purchasing decisions, optimize the sales process, and monitor projects.

The new data Actions function will create and populate forecast models and copy data between models to create more complex transformations. SAP also assures more pre-written financial planning and analysis content and deeper integration of profitability analysis and cash flow planning.

I hope that by now you have had an overview of SAP S/4 HANA Finance. Before you enroll in ZaranTech’s certification course on SAP S/4 HANA Finance, do check out the S4 HANA Finance demo:

99999999 (Toll Free)

99999999 (Toll Free)  +91 9999999

+91 9999999