Career Growth for SAP FICO Consultant

Category: SAP FICO Posted:Mar 14, 2019 By: Robert

In the present scenario, SAP is one of the leading software application providers for many enterprises, for the enhanced implementation of Enterprise resource planning, i.e. (ERP). From the beginning, SAP has been continuously providing tremendous ways for developing management in the domain of Information Technology and Business. Any candidate who wishes to start his or her career as an SAP FICO consultant should know in-depth about and it. In SAP, there are around 28 modules; out of these modules, few are considered mainstream. SAP FICO, i.e. Finance and the controlling module is one of them. In order to fulfill the financial requirements, it has become a choice of many organizations nowadays. SAP FICO is a combination of two different SAP modules, i.e. SAP Finance and SAP controlling, which also involves user management and configuration. In order to make a career as an SAP FICO consultant, the candidates should get certified in the SAP FICO module; this will not only make them eligible to work as an SAP FICO consultant but they can also be able to perform various other roles such as account and Finance executive, senior analyst programmer and many more. To understand the roles and responsibilities of an SAP FICO consultant, an aspirant should know the two essential modules of SAP FICO. Let us discuss them briefly.

SAP FI Module: SAP Financial accounting module is linked with the development of financial management ideas in businesses. In every industry, finance is the most crucial part, which needs flawless management abilities. Presently, it is a difficult and challenging task to manage complete financial accounting manually. Thus, the SAP FI module has appeared as a popular module that is executed successfully in most organizations to carry out the financial and accounting processes smoothly. The complete set of SAP FICO modules helps the organization to manage the financial requirements and accounting activities flawlessly. It enables to the analysis of the financial position of an organization in the real-time market. SAP FI modules comprise of the following components:

Account Receivable, General Ledgers, Asset Accounting Account Consolidation, and Accounts Payable.

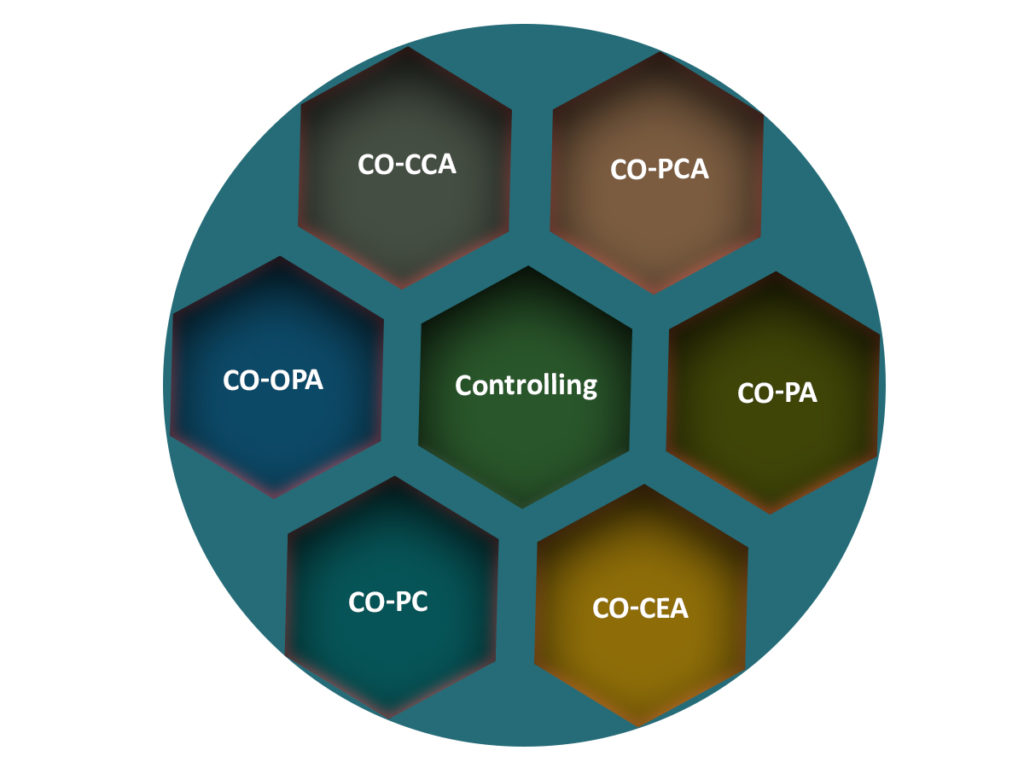

SAP CO Module: SAP controlling, i.e. SAP CO is another module of SAP FICO. With the help of this module, every enterprise can supervise, maintain, justify, and plan various processes. The controlling module is directly connected with the financial accounting module because it helps to view and manage the associated costs. SAP CO comprises controlling and user and involves master data, configuration, and reporting. Masters data includes cost elements, cost centers, profit centers, internal orders, functional area, statistical vital figures, and activity types, whereas cost elements consist of all the cost and revenue accounts, cost centers and profit centers include all the departmental components that manage cost and profit of a business, internal orders consist of all the essential events, etc. SAP CO implementation enables an organization to view the cost of data that is involved within internal management. With the help of this module, the organization can quickly view the financial reporting and manage records as well as take the essential business decisions associated with the organization. Using the SAP FICO module, an organization is able to manage the reporting and information database according to the business requirements.

There are various sub-components of the SAP CO module such as for overhead management, SAP CCA for cost center accounting-related tasks, SAP-OPA for interns auditing for orders, SAP CEL for accounting recovered for cost elements, SAP ABC for activity-based accounting, SAP PCA for accounting related to profit centers, SAP PA which is utilized for analysis of profitability along with each department whereas SAP-PC deals around with costing related issues for the product.

Reasons to Learn SAP FICO: With the help of SAP FICO, Financial management is being advanced continuously in an organization. Currently, SAP FICO is evolving as one of the famous modules and thus provided an increase in career opportunities for many aspirants. Well, there are other various reasons to learn SAP FICO.

1. Growing Importance of SAP FICO: Financial statements, master data, etc. can be migrated to the SAP FICO system. SAP FICO also helps in well organizing the financial management systems which result in better record management and ease in the decision-making process. Managing modifications, product costing as well as production costs have become easy. Across processes, there is more activity-based costing. For notable events, now organizations can keep track of costs where profitability and sales reports are being generated using internal or external measurement.

2. Status of Market Overview: The demand for FICO professionals is not restricted to major cities; it is shared globally. Besides SCM experts, LE, and SAP BASIS the FICO is the most required SAP module. In these areas, there are limited FICO professionals with strong commercial experience. There has been an emerging trend in the volume of SAP FICO work. SAP FICO professionals help the end-user to distinguish the technical features of the module.

3. The most demanding module at present: G/L Configuration, Accounts Payable (A/P), Bank Configuration, and Accounts Receivables (A/R) Configuration, Asset Configuration, Cost Center Configuration, Configuration concerning Analysis of Profitability, Configuration concerning Profit Center, and so on. Classic G/L is assigned with an extension in the form of new G/L along with new functionalities. The Data structure has been extended. Co and FI attain Real-time integration. For parallel accounting, non-leading ledgers are also furnished.

4. ERP FICO: It is quoted as ERP financhttps://www.erpfocus.com/erp-finance-module-features.html#:~:text=An%20ERP%20finance%20module%20gathers,profit%20tracking%2C%20and%20balance%20sheets.e and control. It consists of a real-time function. If a new event occurs, it will update automatically. Earlier conventional systems did not provide the real-time analysis of a company’s financial health, but now it is also possible to use the ERP FICO. FICO module of ERP also meets the requirement of external reporting. It is a standard utility to direct the documents concerning multiple currencies, companies, and countries.

How to become a successful SAP FICO Consultant: Becoming an SAP FICO functional consultant is not a straightway process. To become a successful SAP FICO consultant, the candidates should know the complete summary of the SAP FICO module. In the beginning, the candidate should not expect much salary. The only reason for many to enter this field is profitable income, but they may lose themselves in the pool of SAP resources. It is required for you to invest a lot of time and money before you could have a chance to find a good job in the SAP FICO domain. For the last few years consulting companies are searching for experienced candidates who could come into projects immediately because they may face a high risk of recruiting an SAP fresher.

It takes more than six months to get into an entry-level position in a company as an SAP FICO consultant. If any candidate does not have any financial background, it is suggested that he/ she should take a few months to learn the basic accounting processes and accounting entries which support them to understand the process flow in an easy manner. Most of the companies wish to have an SAP FICO consultant with domain experience because they can understand the process better with SAP.

Below steps can be followed to become an SAP FICO consultant:

1. A candidate should undergo SAP FICO training from an authorized center. These centers provide training in both the modules of SAP FICO, i.e. SAP FI and SAP CO. According to the candidate’s requirements, they can learn any of these modules or both. At the end of the training, the aspirant can take the certification exams which will award you FI or CO certificates from SAP. These certificates are essential to get a job in the field of SAP.

2. Utilize practical training to learn each section of the SAP module. A candidate can devote about three months after certification into practical training to learn SAP FICO.

3. A candidate with domain experience of three to five years can join the big IT companies such as IBM, Accenture, etc. Most of the companies want to have an experienced person rather than a fresher and then train them into their internal project to learn SAP FICO.

Future career opportunities in SAP FICO: As the market is growing, more and more industries are implementing SAP systems. In the next the five years, there will be a huge demand from a financial perspective. There are very few certified SAP FICO Consultants with complete subject knowledge in the market.

Conclusion: SAP FICO is one of the demanding modules of SAP and at present, there are plenty of job opportunities in this field. A candidate who is looking for a career as an SAP FICO consultant should have a complete overview of SAP FICO. A candidate can take up the comprehensive training of SAP FICO instead of going only with SAP FI or SAP CO training because it not only helps to become an expert but also improves understanding for better management of reporting and finance accounting in an organization.

These are the related articles that you can check

- How SAP FICO Impacts the Growth of a Business

- What is SAP FICO?

- Importance of an SAP FICO Consultant in Finance Industry

- Career Opportunities for SAP FICO Certified Professionals

- Why is SAP FICO consultant a profitable role?

That’s all for today. If you’re interested to read more articles on this topic, feel free to visit ZaranTech Blog.

At ZaranTech, we also offer a Self-paced video learning program for Workday HCM mentored by certified and experienced subject matter experts. Browse through our course pages for further information.

Happy learning!

99999999 (Toll Free)

99999999 (Toll Free)  +91 9999999

+91 9999999