Advantages and Challenges in Adopting the SAP S/4HANA Central Finance Approach

Category: SAP S/4HANA Central Finance Posted:Aug 23, 2018 By: Robert SAP S/4HANA is the SAP’s next-generation business suite, which had delivered various advantages to the existing SAP customers. Most of the organizations are migrating towards the SAP S/4HANA, but migrating and updating a current system may result in some challenges, occasionally this could be a complex and risky attempt particularly for the uncertain legacy environment. Let’s talk about SAP S/4HANA in brief. SAP has released various components of S/4HANA for its clients. SAP S/4HANA finance and the SAP S/4HANA logistics are the functional elements offered by S/4HANA. These new tools are developed because the SAP has re-engineered their business application suite to enjoy the performance benefits of the HANA database which also allows a tool that works fine in real-time and combines operational reporting with the business procedures. The significant difference in S/4HANA and HANA database is a essential simplification of the database structure that eliminates the aggregates. Using this the database footprint is decreasing, but it enables the HANA live reports to function in real-time. Allowing real-time reporting in the finance applications produces substantial advantages in decision making and also reduces the time for long-running processes.

SAP S/4HANA is the SAP’s next-generation business suite, which had delivered various advantages to the existing SAP customers. Most of the organizations are migrating towards the SAP S/4HANA, but migrating and updating a current system may result in some challenges, occasionally this could be a complex and risky attempt particularly for the uncertain legacy environment. Let’s talk about SAP S/4HANA in brief. SAP has released various components of S/4HANA for its clients. SAP S/4HANA finance and the SAP S/4HANA logistics are the functional elements offered by S/4HANA. These new tools are developed because the SAP has re-engineered their business application suite to enjoy the performance benefits of the HANA database which also allows a tool that works fine in real-time and combines operational reporting with the business procedures. The significant difference in S/4HANA and HANA database is a essential simplification of the database structure that eliminates the aggregates. Using this the database footprint is decreasing, but it enables the HANA live reports to function in real-time. Allowing real-time reporting in the finance applications produces substantial advantages in decision making and also reduces the time for long-running processes.

Register Today for SAP S/4HANA Central Finance & Get Certified

SAP S/4HANA Central Finance:

Central Finance is one of the major components of SAP S/4HANA. Central finance is not a new creation and does not deliver any new functionality which was not available before, but it is a technique for adopting SAP S/4HANA. This method does not compel the clients to migrate to the SAP HANA database and the S/4 application, but it permits, to duplicate the finance documents into a new central finance instance which is executing on S/4HANA. This method is specifically applicable to those organizations, that has numerous older SAP ERP instances or other finance applications separate from the SAP.

To duplicate financial documents into the central instance, Central Finance exploits SAP HANA’s real-time abilities which provide a real-time economic vision in the organization. Thus, with the help of a central finance approach, it is possible to create a common reporting structure for an Organization.

There is a slight effect to the fundamental source frameworks which are central processing and can be migrated to the central instance immediately to obtain the prompt benefits. However, additional functionality would then be able to relocate in different pieces into the central cases, credit control and outgoing payments would be considered as a good example when combined they deliver the possible financial benefits. Inevitably, all the finance functionality can be migrated in the central instance, and the source financial framework is turned off. It shows a minor risk technique in migrating towards S/4HANA. The central finance approach exploits the SAP Landscape Transformation Replication Server by duplicating the clean accounting documents correctly from any source framework such as SAP or a central S/4HANA environment.

Features of SAP S/4HANA Central Finance:

1. The central finance component can be used to complement the master data and replicate posting.

2. Outlining the master data from the different source systems, i.e., SAP or Nor-SAP to match the master data in the central finance system either manually or using the SAP MDG i.e. Master Data Governance.

3. The mapping between the central finance and source system should be maintained to allow the data transfer between the source systems and central finance; this defines the relationship between data in the source system and central finance.

4. It is possible to transfer the productivity fragment data related to the accounting document to the central finance system.

5. With the help of a document relationship browser, the user can see the document flow of a financial document and also able to access all the link documents in the source system.

6. The Central Finance system collects data from various sources, it then provides a consistent reporting in a single system.

7. The Integrated business planning for SAP S/4HANA, on-premise edition is integrated with S/4HANA Central Finance to deliver a central and reliable insight of the planning process. It includes cost planning, profitability planning, profit and loss planning.

Challenges in Central Finance Approach:

There is a challenge with the central finance approach from a business point of view, how an extra cost related to the central finance approach can be verified? The additional cost is related to the fact that instead of running a single transaction there would be two systems to replicate the financial transactions. Thus, it is essential to preserve and support new central finance as well as a legacy system for a particular time. As the central finance system is going to execute on SAP HANA, therefore the license improvement will already have been acquired before the existing systems. It is needed to be evaluated this cost against the benefits of the transparency of having finances in a particular location and the risk related to the slow advancement to the S/4HANA functionality. Therefore, it is required to evaluate the business case carefully.

There are several IT benefits of moving to SAP S/4HANA related to the minor impression. This impression exists from eliminating the aggregate tables. the business case associated with central finance, migration should depend on business benefits instead of cost reductions in IT.

There are a few extra challenges in adopting a central finance approach:

Technical Complexity: The other components are required to maintain the existing source systems and the central finance system; involving the SLT server presented on a distinct instance and the related updates to the source systems. These include the installation of the data duplication components at the technical level as well as a series of functional level upgrades. Whereas SAP claims that the effect on source systems is negligible, it is required to introduce some of SAP notes into the source systems, this permits the duplication of a document from a source system to the target system. There could be a messive dependency if the recent releases of the source systems are not available and even the support packages are not updated. This will result in a state, where it is required to perform the regression testing of the source systems which will add the extra cost and risk to the project.

Mandatory Competencies: It is required to have some capabilities which are to be constructed in the SLT sever. Well, this is comparatively direct technique and ought to be fascinated into the existing BASIS provider. However, it is also required to develop capability in Master Data Governance, i.e., MDG from both the technical as well as a business point of view.

Architectural anxiety on the central finance method: The financial statements should be drawn either in the source systems or the Central finance system. If it is required to bring the economic articulations from the source framework, possibly the result of allocations and reconciliations carried out in the central framework should be passed once again into the source systems. It is possible that the system records may have altered if the statements are taken from the central systems and thus it is also required to change the integration to combination framework.

SAP S/4HANA Central Finance Structure:

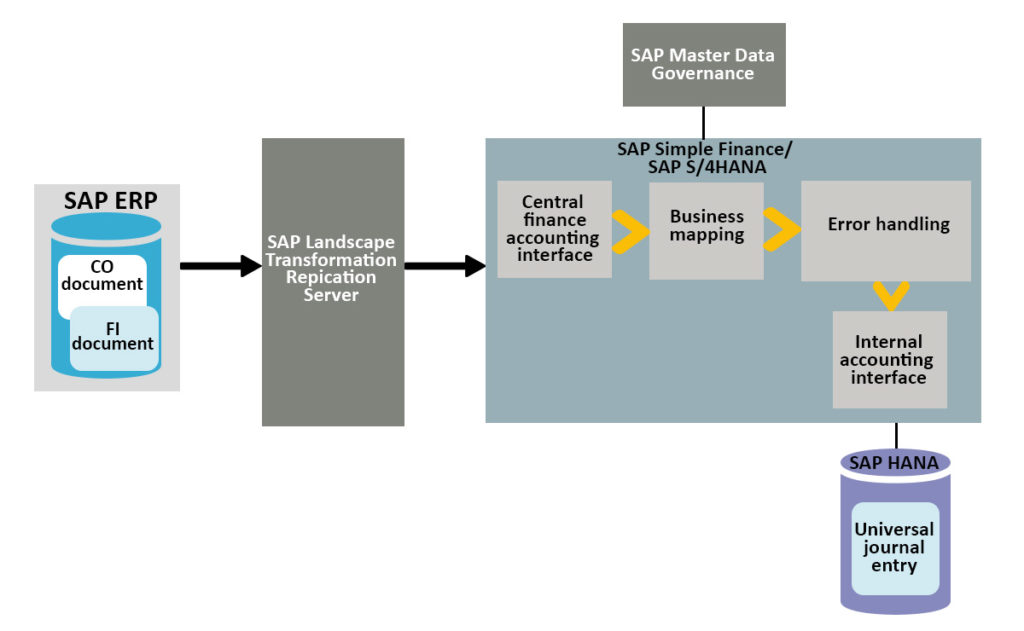

1. SAP S/4HANA Finance and central Finance are utilized with SAP Landscape Transformation Replication Server i.e. SLT and SAP Master Data Governance.

2. The data written to the database in the source systems gets collected by the SLT server and then provide this data into the corresponding Central finance accounting interface.

3. A financial and management accounting document is sent to SAP S/4HANA by the internal accounting interface as a universal journal entry.

4. Once the data is mapped, an error handling document is used by the system to record the details of any errors faced in the system. These errors can be corrected and the item can be reposted again.

Learn SAP S/4HANA Central Finance from Our Industry Experts

Conclusion:

The Central Finance has provided an exciting way to ERP system association and migration towards SAP S/4HANA at a lower risk. It is the most effective approach to deliver some of the advantages of SAP S/4HANA at the initial stage, although streamlining the entire state, it is required to mention some of the points clearly:

- Planning of the Master Data Governance strategy and capability clearly.

- The business case which is harmonizing the effective cost in various systems contrary to the benefits.

- The integration and architectural planning should be carried out for the combined solution.

- Deciding a budget for repairing and to carry out the regression testing.

99999999 (Toll Free)

99999999 (Toll Free)  +91 9999999

+91 9999999