Career Opportunities for SAP FICO Certified Professionals

Category: SAP FICO Posted:May 07, 2018 By: Alvera AntoSAP is the biggest software application provider for businesses the world over. When it comes to Enterprise Resource Planning (ERP), and its implementation, there is no name more well-known than that of SAP. There are numerous ways in which SAP has been providing enhancements in Management across the business and IT domains. SAP FICO aspirants have plenty to learn and many tasks to accomplish.

SAP has around 28 modules in all with a few of them being considered mainstream. SAP FICO is one such mainstream module. This module has been in demand for quite some time by different companies to meet financial needs.

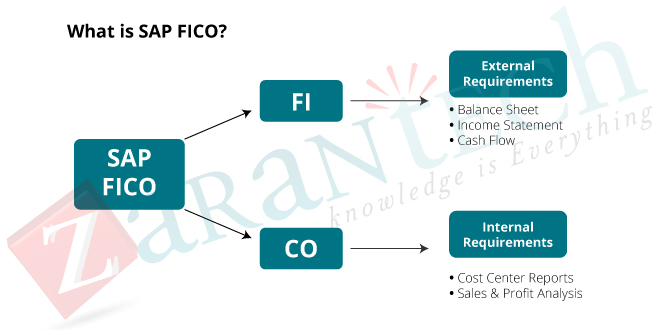

SAP FICO is a blend of two distinct SAP modules – SAP finance and SAP controlling, this also includes user management and configuration. Earning a certification in FICO module will make candidates eligible to work as an SAP FICO consultant, account & finance executive, analyst programmer and a whole lot more. To know what a FICO consultant does, it is advisable to familiarize yourself with the two main modules it consists of.

The necessity of the SAP FI module

SAP Financial Accounting is associated with the improvement of financial management concepts in businesses. All enterprises will have finance as a critical part of it, which calls for flawless management skills. Manual financial accounting Management is challenging and complex. SAP FI is executed for this reason, in the organization to streamline management processes in handling accounts and financial requirements. It helps the company to assess its financial standing in the market.

The FI module includes elements such as Accounts Receivable, General Ledgers, Asset Accounting Account Consolidation, and Accounts Payable.

Since the IT boom in several sectors, companies have demanded more and efficient manpower, but financial accounting is the only department of any organization that seems to lag if automation is utilized because even manpower has its own limitations. Advanced features of SAP FI have made it among the most popular modules to be implemented in any organization. The tools and SAP FI suite comes in the strong amalgamation of a suite those aims to provide top quality service to any organization in an area of financial needs and accounting activities. Since the advent of the internet, the importance of finance and its awareness has reached every nook and corner of the world.

The necessity of SAP Controlling (CO)

SAP Controlling (CO) module helps in supervising, maintaining, justifying, and planning business processes in every enterprise. CO is directly associated with financial accounting, as using it one can view and organize the linked costs. One can also manage and configure master data which spans the information related to cost centres, internal orders, profit centres, cost elements, and more.

The process is managed stepwise comprising organizing, chasing, execution, and reporting. It aids in tracing cost heads to plan consequently. It benefits the costing across processes, based on activities. It supervises product variances, production costs, and it’s costing. It includes constituents associated with Profitability Analysis, Internal Order Accounting, Cost Centre Accounting, Overhead Management etc.

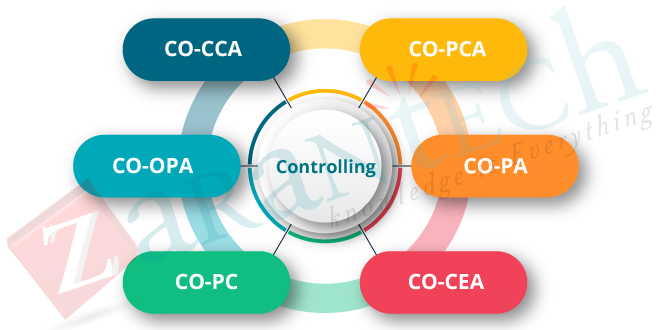

There exist various sub-components of the SAP CO module such as for overhead management, SAP CCA for cost centre accounting-related tasks, SAP-OPA for interns auditing for orders, SAP CEL for accounting recovered for cost elements, SAP ABC for activity-based accounting, SAP PCA for accounting related to profit centres, SAP PA which is utilized for analysis of profitability along with each department whereas SAP-PC deals around with costing related issues for the product.

Summary of both Modules

Both the modules, if correlated, aid the professionals in business management using financial accounting and data management. Financial accounting is a vast field which will require some or most of these skill sets.

- Management and Financial Accounting knowledge

- Configuration Researching, and Testing skills

- Knowledge of the business processes

- Business Support including diverse tasks

Job Description for SAP FICO consultant

Consultants are accountable for system configuration and implementation based on business needs, refining methods, GAAP i.e. Generally accepted accounting principles analysis and eyeing for new projects. Consultants could be either internal or external. External consultants are part of the implementation team. Their role finishes when a project goes live. However, an internal consultant works for the enterprise through implementation and even after the project goes live.

Responsibilities of a Consultant:

- Executing SAP Business Warehouse (BW) in projects.

- Guiding other consultants from MM, PP, PS, and PM modules

- Financial configuration based on business needs.

- Training the recruits and the end-users.

- Offering support in the testing process to discern issues and errors in the documentation or applied business processes.

- Harnessing opportunities for business system enhancement.

Ways to Advance your goal as SAP FICO consultant

While it is recommended to have 2-3 years of experience in SAP FICO modules to be successful as a consultant, like any job, such a requirement can be trumped by passion and dedication to the cause. But a university education will serve as a great advantage in getting jobs as a consultant. It will give you an edge if you possess a Bachelor’s or a Master’s degree in any domain and it will also be helpful to take on subjects related to the module such as financial and management, accounting and management.

To implement SAP is a multifaceted task and needs progressive skills, which can be achieved either by self-study or by sufficient training. It is advisable to make efforts in publishing articles online on SAP forums related to FICO. This will mean that you will be active on SCN, or SAP Community Network. You can also opt for online resources, offered on YouTube or Google consequently. With SCN, you can get to know about necessary educational material which will supplement certified training.

Joining an institution would be a smart move for those who are go-getters. Taking the training of both FI and CO SAP courses would prove too much for any individual. It is advisable instead to opt for SAP FICO training.

Apart from the convenience of integrated and accelerated learning, FICO training builds in-depth expertise while improving knowledge and understanding of the optimal management of reporting and finance accounting in a company.

Conclusion

SAP FI/CO (Finance/Controlling) is the foundation on which SAP made its name. It is an exceptional application for finance-related roles and is one of the most widely held products in terms of scope and implementation. This implies that a very high count of establishments is already using it as well as a steady number of enterprises are adopting it as their financial software platform. This inevitably translates into an urgent and steady requirement for FI/CO professionals which will sustain and grow in the years to come.

Pursuing SAP Financials certification with no overall finance background might prove challenging to land a job. SAP customers have gotten more refined, and they look for efficient specialists that have unrivalled proficiency in their particular domain.

Even if the candidate is fairly new to SAP, HR and operation managers are looking for more comprehensive and profound competence in the functional area the consultant will be working in. So it is advisable to gain some domain experience and then go for SAP FICO certification. This can be easily achieved through certification and training from a reputed institute. To conclude, the career opportunities for a well-trained SAP FICO is as endless as the companies that hire them the world over.

These are the related articles that you can check

99999999 (Toll Free)

99999999 (Toll Free)  +91 9999999

+91 9999999