Contribution Margin Ratio CM Formula + Calculator

Category: Bookkeeping Posted:Dec 09, 2024 By: Serena Josh

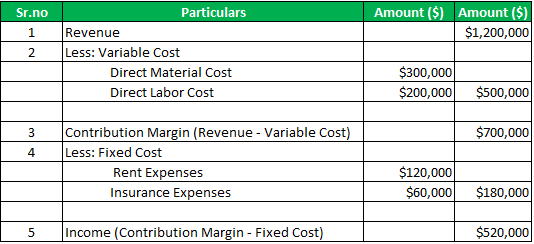

Gross margin is shown on the income statement as revenues minus cost of goods sold (COGS), which includes both variable and allocated fixed overhead costs. Profit is gross margin minus the remaining expenses, aka net income. Once you have calculated the total variable cost, the next step is to calculate the contribution margin. The contribution margin is the difference between total sales revenue and the variable cost of producing a given level of output.

Contribution Margin Formula Components

It gives you an estimate of how much it will cost to run the practice or hospital. It is also used to evaluate if a particular activity or service should be performed at the facility or if it should be outsourced to a third-party provider. The contribution margin can be stated on a gross or per-unit basis. It represents the incremental money generated for each product/unit sold after deducting the variable portion of the firm’s costs. If the annual volume of Product A is 200,000 units, Product A sales revenue is $1,600,000. A subcategory of fixed costs is overhead costs that are allocated in GAAP accounting to inventory and cost of goods sold.

Calculating the Contribution Margin and Ratio

Now, add up all the variable costs directly involved in producing the cupcakes (flour, butter, eggs, sugar, milk, etc). Leave out the fixed costs (labor, electricity, machinery, utensils, etc). Crucial to understanding contribution margin are fixed costs and variable costs.

Use of Contribution Formula

- All of our content is based on objective analysis, and the opinions are our own.

- Furthermore, it also gives you an understanding of the amount of profit you can generate after covering your fixed cost.

- Using this metric, the company can interpret how one specific product or service affects the profit margin.

The gross sales revenue refers to the total amount your business realizes from the sale of goods or services. That is it does not include any deductions like sales return and allowances. In effect, the process can be more difficult in comparison to a quick calculation taking your accounts payable paperless of gross profit and the gross margin using the income statement, yet is worthwhile in terms of deriving product-level insights. Using the provided data above, we can calculate the price per unit by dividing the total product revenue by the number of products sold.

The contribution margin ratio (CMR) expresses the contribution margin as a percentage of revenues. If you were to manufacture 100 new cups, your total variable cost would be $200. However, you have to remember that you need the $20,000 machine to make all those cups as well.

This is the net amount that the company expects to receive from its total sales. Some income statements report net sales as the only sales figure, while others actually report total sales and make deductions for returns and allowances. Either way, this number will be reported at the top of the income statement. It is the monetary value that each hour worked on a machine contributes to paying fixed costs.

This highlights the margin and helps illustrate where a company’s expenses. Variable expenses can be compared year over year to establish a trend and show how profits are affected. Typical variable costs include direct material costs, production labor costs, shipping supplies, and sales commissions.

Thus, you will need to scan the income statement for variable costs and tally the list. Some companies do issue contribution margin income statements that split variable and fixed costs, but this isn’t common. More specifically, using contribution margin, your business can make new product decisions, properly price products, and discontinue selling unprofitable products that don’t at least cover variable costs. The business can also use its contribution margin analysis to set sales commissions. Contribution margin, gross margin, and profit are different profitability measures of revenues over costs.

For example, if a company sells a product that has a positive contribution margin, the product is making enough money to cover its share of fixed costs for the company. The contribution margin is computed as the selling price per unit, minus the variable cost per unit. Also known as dollar contribution per unit, the measure indicates how a particular product contributes to the overall profit of the company. To calculate contribution margin, a company can use total revenues that include service revenue when all variable costs are considered. For each type of service revenue, you can analyze service revenue minus variable costs relating to that type of service revenue to calculate the contribution margin for services in more detail. The contribution margin further tells you how to separate total fixed cost and profit elements or components from product sales.

99999999 (Toll Free)

99999999 (Toll Free)  +91 9999999

+91 9999999