Top SAP S/4HANA Finance Interview QAs for 2020-21

Category: SAP S/4HANA Finance Posted:Jul 06, 2020 By: Alvera Anto

With the listed SAP S/4HANA Finance Interview Questions, you will be able to face your S/4HANA Finance job interview with more confidence. You will get to know what are the key elements of SAP S/4HANA Finance, how to migrate from SAP to S/4HANA Finance, Asset Accounting, Modeling Studio, SAP FI Organizational Structure, and more. Here are some of the top 30 SAP S/4HANA Finance Interview Questions and Answers.

1. What is SAP S/4HANA Simple Finance?

SAP S/4HANA Finance is primarily based on SAP HANA, which can be deployed in the cloud or on-premise. This is designed so that it will be convenient to use, it can deliver immediate insight for finance specialists. It enhances the existing finance solution portfolio from SAP, its purposeful strength remains the same while enabling non-disruptive migration.

Click here to Know More about SAP S/4HANA Finance

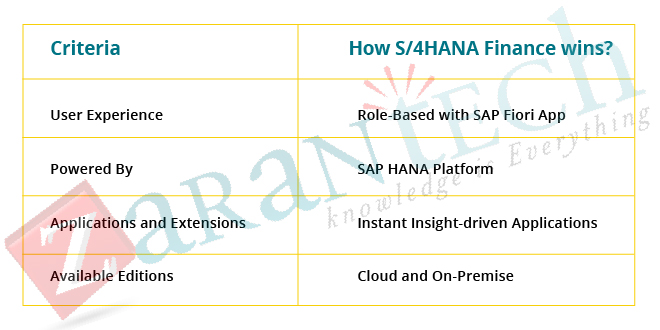

2. List the key elements of SAP S/4HANA Finance.

The following are the vital aspects of SAP S/4HANA Finance:

- Financial Planning and Analysis – With SAP Finance, companies can forecast, price range, and layout as an ongoing approach. With the benefit of predictive Analysis, groups can forecast to have an effect on commercial enterprise decisions on their organization’s economic reports.

- Finance and Accounting – With the benefits of Advanced Accounting and Finance features, corporations can meet criminal terms. Further, they can finish the reviews of Finance on time.

- Financial Risk Management – With the advantage of Predictive Evaluation, organizations can determine the existing risks in the processes of Finance at the initial stage and take action to correct them. It is easy to determine the exceptional feasible funding costs related to the market standards.

- Compliance and Risk Management – With the robust economic approach, it is easy to keep away from unapproved get right of the entry to important facts in the enterprise. It is easy to perceive abuse as properly as a fraud. The corporations can be in a position to minimize the risk issue in whole financial processes.

3. What is the Posting Period?

The posting duration variant controls which posting periods, both regular and special, are open for every organization code. It is viable to have a one of a kind posting duration variant for each enterprise code in the organization. The posting length is independent of the fiscal year variant.

4. State the ways of Migration from SAP to Simple Finance?

Few ways that how corporations can move from SAP traditional FICO module to Simple Finance (that is SFIN 2.0). The ones that are new GL are capable of moving directly to Simple Finance. Those who are on usual GL intend to migrate to New GL first and then migrate to Simple Finance. This sort of migration happens only with SPRO and doesn’t need technical aid. There is a distinction when migration is from the central factor of Finance that sustains with shifting information dispensed Enterprise Resource Planning panorama and non-SAP Enterprise Resource Planning, utilizing SLT.

5. In SAP Simple Finance, even in case the client never uses the Asset Accounting, Is it compulsory to have a new Asset Accounting?

In Asset Accounting, in case there is no data that refers to both customizing and transactional facts that have to be moved, in such a scenario there is no required for doing the migration steps in Asset Accounting. If the consumer chose to use the Asset Accounting in their new Asset Accounting later, then they can set up the personalizing in the IMG.

6. What is Modeling Studio?

There are several tasks a modeling studio performs in SAP S/4Hana Finance. A few of them are protected in the following: Handle Data Services in order to enter the records from the SAP Business Warehouse States, which tables are placed in HANA, the preliminary thing is to receive metadata and then software data duplication tasks, Utilize Data services for modeling, Manage ERP requests connection Perform modeling.

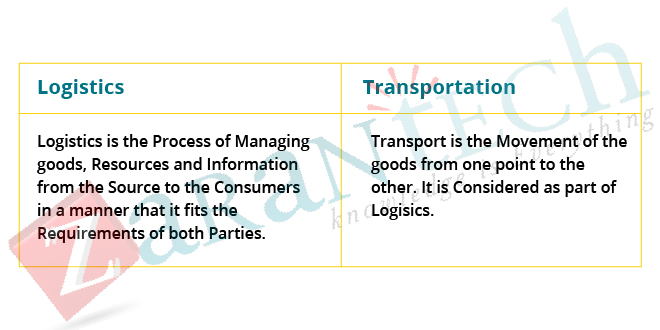

7. What is the distinction between Logistics and Transport?

The following table gives the difference between Logistics and Transport:

8. Is it viable for a company to have an excellent quality money float nevertheless additionally remain in serious monetary difficulty?

Yes, it is. An organization that is selling off stock but delaying payables will show beneficial money float for some time even although they are in trouble. An additional instance would be where an employer has robust revenues for the length but future projections reveal that revenues will decrease. This would manifest when a business enterprise hasn’t focused on ensuring there have been new prospects/sales in the pipeline.

9. How is Account type related to File type?

We can differentiate the document type with a 2-character code like DG and more however an account type is designated by a single character code like D and so on. Defining which debts a unique file can be posted to. The frequent account types include:

- A Assets

- D Customer (Debtor)

- K Vendor (Creditor)

- M Materials

- S GL

10. Is it possible to exchange an existing B/S, GL A/C to the P/L type?

Technically, you will be in a position to exchange all the fields, without the account number, of a G/L account in the Chart of Accounts area. Nonetheless, on this specific event when you Change the B/S to P&L in the GL account type then can be sure that it is stable to carry the application forward by saving the changes which will help the system to correct the suitability for the account balances.

11. What are the various available compression techniques?

There are three sorts of accessible compression techniques namely:

- Cluster Encoding

- Run-length Encoding

- Dictionary Inscribing

12. What is Document type?

SAP comes delivered with a number of document types, which are used in numerous posts. The record type assists to classify an accounting transaction within the system and is utilized to handle the complete transaction and identify the account types a precise document type can submit to.

As an example, the file type AB allows you to submit to all the accounts, whereas type DZ allows you to submit only the customer payments. Every report type is assigned a number range. The common file types consist of:

- AA — Asset posting

- KG — Vendor credit score memo

- AB —Accounting document

- KN — Net vendors

- AF — Depreciation postings

- KR — Vendor invoice

- DG — Customer credit score memo

- KZ — Vendor payment

- DR — Customer invoice

- KG — Vendor deposit memo

- DZ — Customer payment

- SA — GL account document

- X1 — Recurring entry doc.

- X2 —Sample document

13. What are the essential grant chain challenges that organizations face?

The five big challenges that organizations face these days are:

- Ignoring the ongoing growth of e-commerce as a channel in the industrial zone.

- No attention to the practicable risk like risky transport costs.

- Over expectation that furnishes chain administration technologies will fix everything, over-reliance on past performance to anticipate future sales.

- Boost complexity delivered to equip chain operations with the implementation of pointless applied sciences.

- Lack of understanding of the complete abilities of suppliers and service.

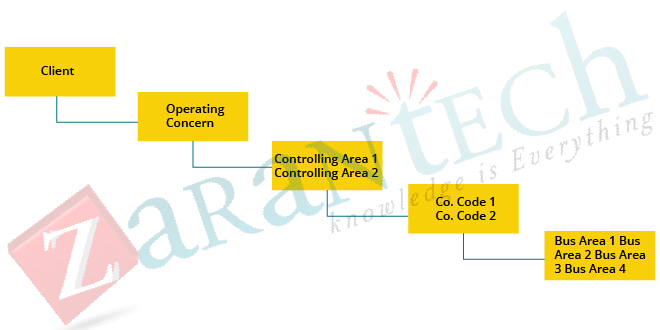

14. What is the SAP FI Organizational Structure?

In this image, SAP FI Organisational Structure is mentioned. With the help of this image, aspirants can easily understand.

15. How is it viable for the employer to show excellent quality net earnings and declare bankruptcy?

Two instances consist of deterioration of working capital (i.e. growing accounts receivable and lowering bills payable), and monetary shenanigans.

16. What is deferred tax liability and its purpose?

Deferred tax liability is merely contrary to a deferred tax asset. The deferred tax liability happens when a tax price claimed on the earnings statement is not paid to the IRS in the course of the same length it is recognized, it’s paid at a future date.

When there are differences in depreciation price between ebook reporting and IRS reporting, deferred tax liabilities can end up resulting in invariants of profits as reflected on a company’s earnings assertion versus what’s recommended to the IRS and which results in lower taxes payable to the IRS (in the quick run).

17. What is the most crucial assistance that SAP Simple Finance does?

SAP Financial and Controlling module (one of the center modules of SAP from its R/2 days) is a virtually advanced presentation with high-quality width and profundity. SAP Simple Finance offers extreme in-memory reporting that takes out the limit between controlling and cash relevant reporting, integrating arranging capabilities, and improving liquidity examination. PWC can boost the execution of SAP Simple Finance to Finance work and turn into an appropriate venture partner.

18. Is it possible for a company to have positive cash flow yet remain in severe economic difficulty?

Yes indeed, it is. An organization that is auctioning off stock nonetheless postponing payables will show favorable revenue for a while, despite the fact that they’re embedded in an unfortunate situation. An additional case would be the place an organization has strong incomes for the period nonetheless future projections show that earnings will decrease. This would happen when an organization hasn’t focused on ensuring there were new prospects/deals in the pipeline.

19. Describe grouping as well as levels.

Grouping figures out how to summarize the data, with quite a number of defined groups and degrees. A Group builds up a variety of financial institution debts and includes a variety of Levels. A-Level, therefore, signifies the sources of data or account transactions.

20. What is the Transport Request?

Transport Request is a type of a collection of changes that are made in the development system. The information related to the kind of modification, the objective of transport, request category, and the target system are all recorded. It is likewise referred to as change Requests.

21. What makes a desirable Financial Model?

It is important to have robust monetary modeling fundamentals. Wherever viable model assumptions (inputs) require to be in one location and incredibly colored (typically financial institution models use blue font for mannequin inputs). Good Excel models additionally make it convenient for customers to recognize how inputs are translated into outputs. Good Excel models additionally include error tests to ensure the mannequin is working efficiently (e.g. the balance sheet balances, the money glide calculations are correct, etc.). They contain ample detail, but no longer too much, and they have a dashboard that sincerely reveals the key outcomes with charts and graphs.

22. Why do two agencies merge?

To obtain cost savings, acquire new technology, get in new markets, eliminate a rival, and since it’s “accretive” to financial metrics.

23. Why do capital expenses enlarge a corporation’s assets, while different expenditures like paying tax, employees’ salaries, utility bills, and so on do not amplify an organization’s assets base, but as a substitute shows up as a fee on the earnings announcement that decreases equity by means of retained earnings?

Unlike regular costs that provide benefit over a short period of time (i.e., employees work, taxes, and so on), capital expenditures supply an advantage over a longer duration of time because of the period of their assessed benefit, usually, various years, capital charges are capitalized by the stability sheet, the place shorter time period bills are expensed on the income statement. This is the difference between an asset and an expense. You’ll favor to start with internet income and then proceed the line by means of the line through the important changes (depreciation, deferred taxes, and working capital changes) required to arrive at cash glide from operations. In your rationalization you’ll additionally choose to mention the following:

Capital Expenditures, buy of intangible assets, sale of actual assets, and also purchase/sale of investment securities to locate money float generated from investing activities. Issuance/repurchase of the department, sale of equity, and payment of dividends to locate money float from financing activities. Adding the cash flow from operating, investing, and financing activities you are in a position to come up with the entire alternative in cash. Users can arrive at the money balance at the stop duration by taking the cash stability at the establishing of the length and adjusting it for the entire alternate.

24. What is the document alternate rule?

The principle document of SAP doesn’t allow changing the relevant fields as soon as a file is posted, any adjustments can only be completed via Reversal or additional postings. Currency, employer code, business area, amount, account number, posting key, etc., are few fields that can never be modified once the document is posted. Nevertheless, SAP approves changing some of the fields in the line objects such as a charging method, charge block, residence bank, dunning level, dunning block, etc. These can be modified files by means of file or by using the usage of mass alternate for a range of archives in a single step. The modifications to understand information are tracked and stored per person for an audit trail.

25. In Simple Finance even if the customer never ever uses the asset accounting, is the New Asset account mandatory?

In the case of Asset Accounting, there is no data, which describes the both transactional as properly as the customizing data, which needs to be migrated, in such situation, there is no compulsion for executing the migration step in Asset Accounting. If it is decided to use Asset Accounting later in new asset accounting, then you can set up the customizing in the IMG.

26. What is activity-based costing?

It is an approach that aids the failure of the expenditures into particular things to do in order to the maintenance of accuracy in the distribution of charges in product costing.

27. How many Charts Of Accounts (COA) can be attached to a Company Code?

One or extra operative chart of accounts can be assigned to an organization code. COA should be assigned to a business enterprise code. This COA is the operative COA and is utilized in both FI and CO. One Chart of Account can be assigned too many Company codes i.e., a number of business enterprise codes can either share the similar or have separate COA. Yet a corporation code (Country specific company code or International company code) can have a precise COA also in addition to Operative COA. The hyperlink between the normal COA and the US COA shows up in the alternate quantity area of the G/L master record.

28. What are the substitutions and validations? What is the precedent?

Validations are used to take a look at settings and return a message if the prerequisite takes a look at the condition is met.

Substitutions are similar to validations; they surely exchange and fill in field values at the back of the scenes besides the customer’s expertise as opposed to validations that create on-screen messages to the user.

29. What are the required configurations for Bank Statement Processing?

These are following described configurations required for your system:

- Start Variant

- Search ID

- Processing Type

- Internal Bank Determination

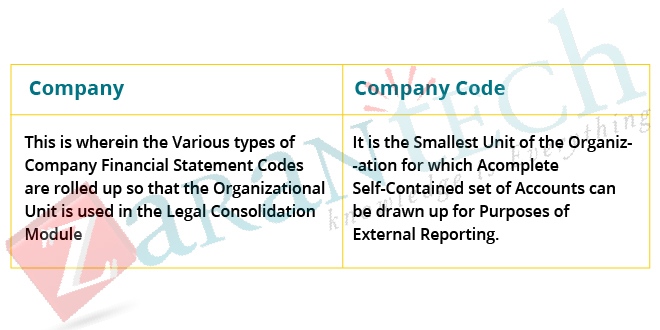

30. What is the difference between the Company and Company Code?

Bottomline

With the knowledge of the SAP S/4HANA Finance, you will be able to do the S/4HANA Finance related work with self-confidence. I hope these few questions will help you to construct a thoughtful and understanding approach so that you could encounter the interviews. All the Very Best!

I hope that by now you have had an overview of SAP S/4 HANA Finance. Before you enroll in ZaranTech’s certification course on SAP S/4 HANA Finance, do check out the S4 HANA Finance demo:

99999999 (Toll Free)

99999999 (Toll Free)  +91 9999999

+91 9999999