Transforming the Financial Reporting and Analytics using SAP S/4HANA Finance

Category: SAP S/4HANA Finance Posted:Apr 12, 2018 By: Ashley Morrison

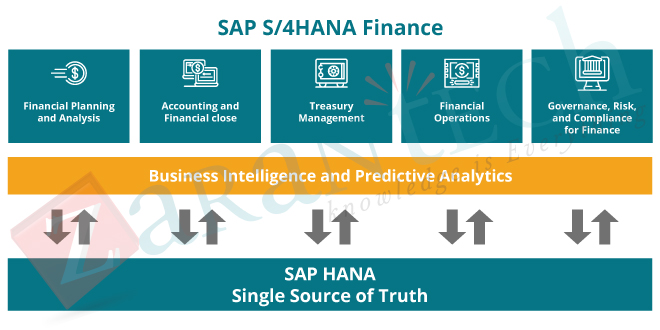

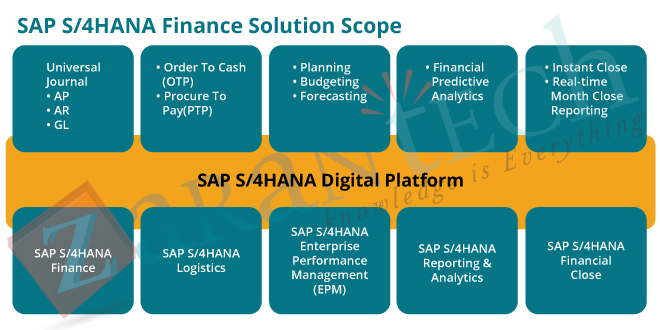

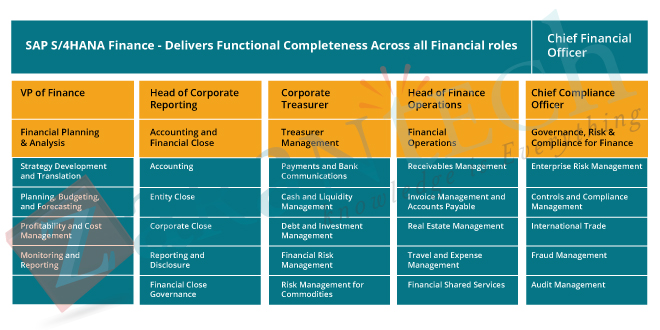

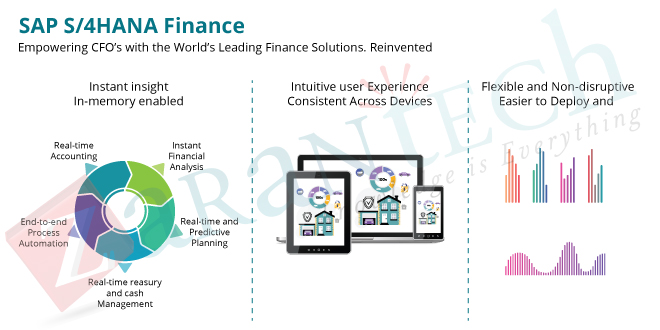

Technology is changing at a rapid pace with each day bringing in lots of disruption. Disruptive technology refers to any new tech that can do a particular set of tasks at a fraction of the time, cost, or both. Even newly birth technology can become obsolete in a short span of time. In these days of volatility, an organization requires robust and updated technology to meet their requirements. An organization has to cater to the needs of customers, investors, and employees. In all these relations the most important adhesive is financing, which holds the various stakeholders together. The indicator of the success of the business is how well they are managing their finances. A good salary paying organization will always have outstanding employees. The pay is great when the organization is registering profit. This will make investors happy. But for all these things the organization needs tool excellence in accounting, reflecting the same in the balance sheet, cash management, and forecasting and budget management. In order to meet all these requirements, SAP S/4HANA is a one-stop solution for the finance department of the tech organization of today. The process in this tool is designed to meet the requirements of the CFO in the digital world. It is one of the best, innovative, leading finance solution platforms for SAP. It provides data sanctity which helps in maintaining data consistency and reduces errors throughout the organization. It allows real-time monitoring of financial and accounting processes across the organization. It permits what-if analysis, simulation, and prediction for business planning. This allows the customer to make a decision and make a strategic evaluation of their business without any lag of time.

The benefits provided by SAP S/4HANA include easy closing of a financial statement when required, in the area of planning and predictive finance, real-time cash management and forecasting, budget management, continuous monitoring and scanning of high volume data.

Checkout the Article-SAP HANA, S/4HANA, and S/4HANA Finance in a Nutshell

Easy closing of Financial Statement Anytime:

The efficiency of the organization is a measure of how fast an organization closes its books (accounting terminology). A study, by the engineering group of SAP, found that the top quartile performing company does the annual financial closes in 26% fewer days than their peers. This helps in reducing 61% lower ledger and closing costs. The unique benefits of this feature of SAP S/4HANA are:

It offers a single source of financial data with a common view. This helps in maintaining the consistency of data. It also minimizes replication of data. It is the universal journal for financial data.

It helps in real-time monitoring of data and takes relevant decisions on time. There is continuous visibility of financial reporting. The management also has full visibility of closing stocks. The management can also go through continuous inter-month processes. There is a removal of bottlenecks during the end of period data.

The universal journal of financial data helps central finance to consolidate many back end processes. It also leads to the automation of routine tasks. The real-time data with key performance indicators are refreshing instantly. This enables the central finance team to keep track of key performance indicators.

Planning and Predictive Finance:

It is important for an organization to have instant financial analytics across multiple departments. After getting the data it becomes very important for an organization to analyze the data. Data modelling and prediction is done to test the potential impact of strategic business decisions. SAP S/4HANA provides the option of using planning and what-if analysis, to predict both forward and backward strategic decisions for your business. The special benefits of this feature of SAP S/4HANA are:

There is a wide usage of real-time simulations and prediction. The process helps in building a model of business patterns like operating costs, revenue margin. The process is rapid and beneficial in taking key decisions.

It analyses various trends, patterns, correlations obtained from the business performance. It does cost analysis and real-time revenue prediction. This enables the finance department to do continuous planning and forecasting for a month, quarter and year. The real-time monitoring also helps in updating the earlier forecast with no time lag.

There is a single view of all planning and forecasting information. The planning of data across the organization remains consistent. Every department remains aware of the planning of the other departments within the organization. This brings synergy in the organization and help in achieving more success. There are no silos.

The accuracy of data forecasted using this feature increases and the profit margin to improve. There is maximum utilization of cash flow.

Real-time Cash Management and Forecasting:

The study conducted by various organizations shows that cash management and forecasting is one of the crucial functions of the central finance team. It is of the greatest importance for them. But it is one of the most challenging tasks to do. However, SAP S/4HANA can swiftly do real-time monitoring, with a flexible and user-friendly interface. The new cash management system includes analytical functions and other cash related transactions. The other benefits of using this feature of SAP S/4HANA are:

Since there is one common view of data throughout the organization to maintain the consistency, this helps in getting real-time information about all the cash balances. There is an integration of liquidity management, cash flow analysis and embedded planning. The central bank account is also managed. Thus, it reduces the risk of mishandling of data. The data are integrated because of synchronized and harmonized data model.

The prediction, simulation and analysis help in maintaining consistency by forecasting cash balances, cash management and liquidity strategies. The different data parameters obtained help in determining the key drivers behind working capital. This helps in focusing organization efforts towards key drivers that are generating working capital. This saves the organization time and energy.

The cloud solutions used to offer this facility are flexible and non-disruptive. There is also a facility of deployment of cloud services.

Budget Management:

The budget management feature is one of the basic functions of the finance department of any organization. The central finance team monitored various processes carefully. This process helps in allocating money as per the needs of the various departments of the organization. A deep analysis is necessary to get real and future expenses. The most important aspect is to take critical decisions about future expenses. The SAP S/4HANA model is designed to meet the need of budget management for the organization. The benefits included in this feature are:

There are real-time monitoring and forecasting of data happening on a daily basis. This helps in getting an early view into future expenses before financial budget exceeds. The management can take necessary decisions like channelizing their budget into required departments or overheads. There are proper control and management of the budget.

This also helps in simulations of decisions about expenses and the budget situation of the organization. The manager has the options to adjust the reporting model as per the needs of the organization. The manager is given a real-time forecast of future cost development. They have real-time insight into budget expenses and a recent overview of expenses requests.

The advantages of using this feature are that decision-making becomes simpler and faster. The organization remains aware of their budget. The chances of exceeding the budget remain zero. There is a reduction in unnecessary costs. The savings are used for maintaining key performance indicators. It dynamically improves the budget management process.

Continuous Cross System Control Monitoring:

Continuous Cross System Control Monitoring is the key to the success of any profitable organization. The time spent by control and compliance expert in performing control operation is significant. They use manual processes to perform control operations. However, the result obtained from them is outdated and not up to the mark. The failure in control and compliance is the biggest risk for any organization. But, with the latest innovations, SAP Process Control application help in test controls, finds problems involved and provide a solution for them as soon as possible. This helps the organization in reducing cost and leads to efficient use of the efforts. The unique features of this are:

The monitoring of processes and controlling data are done easily from the central repository data using automated high-quality business guidance system. The data are continuously tested and monitored across large data volumes. The power of automated testing and monitoring rules is also enhanced.

The best aspect here is one common view of control effectiveness across the organization. This allows monitoring of problems across multiple dimensions timely and resolution of them as soon as possible. There is a systematic alignment of business. This reduces cost and efforts and data reliability increases across the organization.

Such high performance augments high transaction volumes. It also provides robust views for CCM rules created by structured query language or graphical user interfaces.

Scanning High Volume Data for Potential Fraud:

The data used in the organization are obtained from various sources like the customer’s data, inventory reports, financial transactions, marketing details, phone calls, etc. These data sets are kept in various forms like spreadsheets, loose sheets, emails, etc. These data are also used by other stakeholders, including auditors, third-party collaborating organizations. In this scenario, it becomes difficult to protect the data and keep up the sanctity of the same. The risk of fraud increases as it is difficult to find the leak. If fraud is found at later stages, then it impacts the company’s reputation and overall business.

There is real-time monitoring of data in SAP S/4HANA. There is powerful user-friendly analytics to fight fraud. There is rapid scanning of the high volumes of data. If any fraudulent patterns are observed, then rectifying measures are taken in time. This helps in preventing damage and protects the business.

The transactions are also monitored in real-time. There is a notification for any suspicious transactions and such transactions are blocked. There is a fraud calibrator for multiple simulations to minimize false positives. This allows for the reduction in efforts of investigation workload and increases prevention effectiveness.

There are simulations and prediction analyses of the high volume of data to detect and prevent fraud. This helps in detecting fraud patterns and loopholes. The anti-fraud processes are strengthened for the existing system. Also, the cost required to look fraud investigation process decreases by using this system.

Go through our SAP S/4HANA SIMPLE FINANCE EXAM C_TS4FI_1610 Certification Made Easy to crack the Interviews.

In this world of rapid transformation, there is a need for continuous innovation in every aspect of businesses. Any organization cannot allow itself to be left in the race. The focus should be on continuous product innovation, expanding business, and giving an awesome customer experience to the organization. But to achieve this organization need an excellent system. A good system placed in the organization will provide outstanding results. It increases the overall efficiency of the organization. Keeping this in mind SAP S/4HANA provides an opportunity to transform the financial system of the organization in every aspect. It is utilized in various works like easy closing of financial statements anytime, for planning and predictive finance, real-time cash management and forecasting, budget management, continuous cross-system control monitoring, or scanning high volume data for potential fraud. This portfolio covers all aspects of finance and allows finance professionals to perform exceptionally well in this volatile digital economy. The bottlenecks from the system are removed. There is an increase in overall efficiency. The prediction and simulation process increased the overall capacity of a manager in taking appropriate decisions as per the need of the time. The organization’s optimum performance increases without exceeding the proposed budget. There is a robust control system in place. Fraud prevention increases within the organization. SAP S/4HANA Finance provided an end to end benefits to customers across the entire financial portfolio. The efficiency of the organization increases dramatically and transformed the whole business system. SAP S/4HANA Finance is available with on-premise, cloud deployment options with minimal disruptive migration paths for new and existing SAP customers.

Checkout the Article-Users Should Know About: SAP S/4HANA Sourcing & Procurement

Conclusion

Considering the vast set of benefits offered by SAP S/4HANA Finance, it makes sense for organizations across domains and business verticals to adopt it or at least plan a migration scenario in the immediate future. This will lead to such organizations streamlining their Finance processes and boosting their bottom line.

I hope that by now you have had an overview of SAP S/4 HANA Finance. Before you enroll in ZaranTech’s certification course on SAP S/4 HANA Finance, do check out the S4 HANA Finance introduction:

99999999 (Toll Free)

99999999 (Toll Free)  +91 9999999

+91 9999999