I would like to take this opportunity to say Thank you to the ZaranTech team for all your help in getting my resume out and helping me and guiding me through this process. Initially I was reluctant about this online course.Once I joined the course, Read More

-

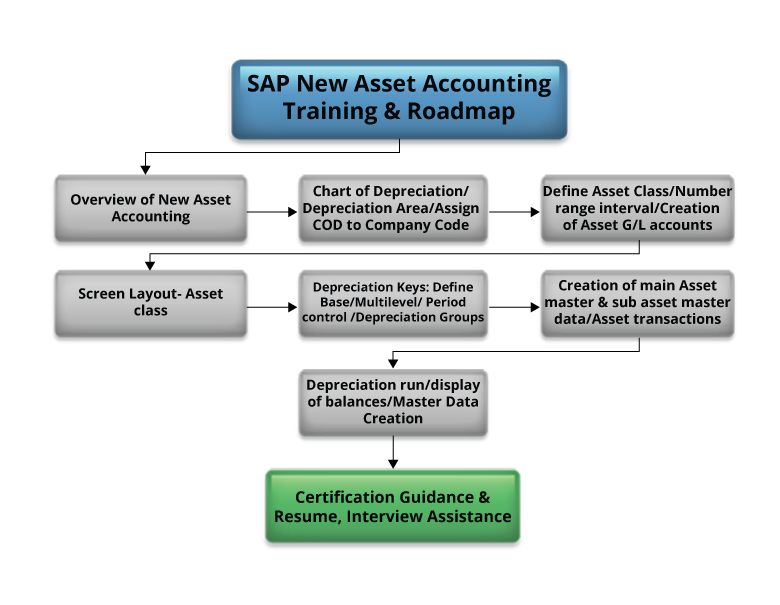

- Overview of New Asset Accounting

- Changes in Asset Accounting

- Configuring Basic New Asset Accounting

- Configuring Fixed Asset Accounting

- Depreciation and Calculation Methods

- Defining Depreciation Areas

- Determining Depreciation Areas in Asset Class

- Fiscal Year Specifications

- Developing Enhancement for determining Company Code Relationship

- Asset Class and its Usage

- Asset Class Creation

- Changing the Field Status of the Asset G/L Account

- Posting GL Account Document for Ledger Group

- Set or Reset Reconciliation Accounts

- Technical Clearing Account

Screen Layout Rules- What are directives

- Depreciation Keys

- Period Control Method

- Maintaining Period Control Method

- Straight Line Method

- Changing Key Words in the Evaluation Group

- Defining Validation and Substitution

- Master Data

- Acquisitions – Defining Transactions types for Acquisition

- Transaction Types for Transfer Posting

- Transaction types for Retirement

- Defining Transaction type for Post Capitalization

- Defining SAP Queries

- Defining Document type for Legacy Data Transfer

- Changing Asset Settings – Master Data

Certificate of Completion(Sample)

Generic SPVT Training Faqs:

Self-Paced Video Training (SPVT) program is designed to learn at your own pace. Students are given access to the LMS system and learn through pre-recorded session videos. They can access the assignments and materials through the LMS system. 24×7 access to Support is available. To know more about SPVT, watch the video Self-paced Video Training (SPVT) – https://www.youtube.com/watch?v=1P6eGOSl-Lk

All Instructors from ZaranTech are working professionals from leading organizations who have minimum of eight years of real-time consulting experience working on live projects and good subject knowledge. They have more than three years of experience in training. Most of our trainers are certified professionals as well and help the students to get certified.

We will help you to setup Virtual Machine in your system with local access. The detailed installation guides will be provided for setting up the environment. In case, your system doesn't meet the prerequisites e.g. 4GB RAM, you will be provided remote access to the Server for the practicals.

For any doubt, our 24*7 support team will promptly assist you.

As soon as you enrol to the course, an immediate access to our course content in the form of Videos, PPTs, Assignments and Assessments will be provided so that you can start learning right away.

Yes! You will have a lifetime access to all the course materials.

Yes, we provide Placement Assistance. We help our students to get connected to the prospective employers by working with our sister consulting firms in the USA. In addition, our training program also provides Certification guidance, Resume, and Interview preparation assistance. To know more, watch the below videos:

ZaranTech – Interview Preparation Assistance – https://goo.gl/w3qcyP

ZaranTech – Resume Preparation Assistance – https://goo.gl/8gWz9O

Trainee can choose any of the following payment methods to enrol to our training program:

For USD payment, trainee can pay by PayPal and Bank of America

- Bank payments from anywhere in USA

- Money Orders

- International Wire Transfer

- ACH Transfers

- Chase QuickPay

- Bank of America Transfers

- Wells Fargo SurePay

Note:

- Installment option is also available

- We accept credit card, debit card and net banking for all leading banks

To know more about our Terms of Service including the Refund and Cancellation policy, please visit our webpage, https://www.zarantech.com/enrollment/terms-of- service/.

You can raise a ticket from the Blog and a Support team member will respond to your query. For any doubt, our 24*7 support team will promptly assist you through our ticketing system.

We cannot share the trainers Linkedin profile but we surely can send you a screenshot of it. This is because the trainer don’t want to be contacted through inmail as they themselves are Sr. consultants/Solution architects at reputed firms and keep very busy with work. This is something we are telling from our past experience. Rest assured, please know that the experience of the trainers are what they say. You can also attend a Live Demo webinar with the trainer and ask any question to them and get a clarity on trainer’s experience and subject knowledge.

Description

The SAP New Asset Accounting(FI-AA) module is an example of a financial module that has been redesigned in the S/4 HANA suite to increase process efficiencies across the lifecycle of an asset. SAP New Asset Accounting offers immense benefit over traditional Asset Accounting. Our training program focuses on managing FI-AA master data and on the handling of the various business processes in FI-AA, it includes topics like periodic processing, evaluation and depreciation and standard reporting. As FI-AA is a sub-ledger of FI, trainees can learn about organizational structures in Asset Accounting and FI, methods to configure of FI-AA in SAP Customizing, to find out how configuration possibilities can affect the application and the business processes.

Did you know?

1. New functionality is available in SAP New Asset Accounting to manage Parallel Valuations. You can handle parallel valuation of your assets using both the ledger approach and the accounts approach.

2. Data redundancy has reduced, and you have to use fewer FI-AA tables. Actuals is stored in the universal journal (ACDOCA) instead of in a variety of tables (including ANEP, ANEK, ANLC, ANLP, and ANEA). Plan and statistical data are stored in individual tables.

3. A mix between human and pure robot advice called Cyborg advice represents a paradigm shift in the path of change in the sap New Asseting Accounting management industry.

Why learn and get Certified in SAP New Asset Accounting?

1. Companies of all sizes subject to increased scrutiny by government agencies, regulatory boards and investors, accountability where transparency is the solution.

2. SAP New Asset Accounting minimizes asset register error rates and increases capital efficiency with optimized SAP asset accounting operations.

3. According to the research results, there is a huge demand for resources in the space of asset management jobs. If you are a newly-qualified accountant, now it’s a good time to take stock of your career options.

Course Objective

After the completion of this course, Trainee will:

1. Configure the Asset Accounting module

2. Create and change master data in Asset Accounting

3. Understand Asset Class, Number range interval, Depreciation keys, Screen Layouts

4. Attain knowledge of depreciation run and transactions

5. Identify which FI-AA reports you need to analyze asset values

Pre-requisites

1. AC010 Business Processes in Financial Accounting

2. Basic knowledge in Bookkeeping

Who should attend this Training?

This comprehensive course is meant for professionals who aspire to build a career or upgrade knowledge in Asset Accounting. This course is best suited for the following professionals

1. Application Consultants

2. Project Manager

3. IT Support

4. Power Users

Prepare for Certification

Our training and certification program gives you a solid understanding of the key topics covered on the SAP Inc. In addition to boosting your income potential, getting certified in SAP New Asset Accounting demonstrates your knowledge of the skills necessary to be an effective SAP Asset Accounting Consultant. The certification validates your ability to produce reliable, high-quality results with increased efficiency and consistency.

Sign in with Social Account

Login With FacebookLogin With twitterLogin with Google Plus